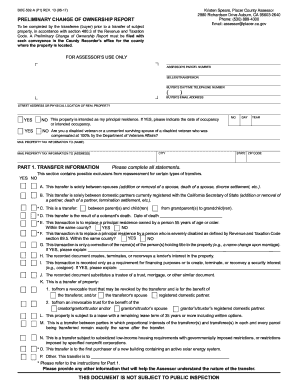

CA BOE-502-A (P1) 2022-2024 free printable template

Get, Create, Make and Sign

Editing 11 preliminary change latest online

CA BOE-502-A (P1) Form Versions

How to fill out 11 preliminary change latest

Video instructions and help with filling out and completing 11 preliminary change latest

Instructions and Help about alameda county pcor form

Hello today I am going to talk about the preliminary change of ownership form or the POOR as we call it in the industry again another government form one that requires the buyer to look it over fallout boxes fill out blanks and buyers never like it, but there is a reason for this form, and it is a very important reason the main function of the preliminary change of ownership form into figure out what kind of taxes the county is going to assess against the property there are four basic functions of the form first they want to know who the new buyer is going to be secondly they want to know what is the purchase price of the property thirdly they want to know whether the homeowners' exemption is going to qualifying your case and fourthly they need to know if they do not need to reassess the property at all our buyers are requested to fill out this two-pageform and as I say they have no patience for it first there's a bunch of questions they need to ask you and secondly there are a lot of blank lines that you need to fill out but if you don't fill out this form well you'redoing to be charged an additional $20per recording of your grant deed and that is not good the story doesn't end there it×39’s not just a preliminarchangoffof ownership form that the buyer has to complete within about four to six weeks after your escrow closes and the grand deed is recorded you're going to get another form and it×39’s callechangegoffof ownership form again this form is very important and because it looks justlike the preliminary change of ownership form buyers tend to ignore it and even throw it away which becomes a really bathing first if you do not fill this form out and return it to county Assessor's Office you can recharge a penalty of five thousand dollars if this is a principal residence and if this happens to be an incomepropertywell the fee goes up to twenty thousand dollars let's say that you are transferring the property not as a sale but as a transfer to your children or from the trust now this transfer would not be reassessed to your property right correct however if you're done×39’flouted there change of ownership form or the preliminary change of ownership form then the county won×39’t knoanthemhe willll reassesses your property so the next time you get a preliminary change of ownership form or a change of ownership form after the close of escrow remember this video and fill out the form because if you don't your property taxes could be putting right on the line thank you my name is Juliana to and I hope that this video has been of interest to you

Fill change ownership alameda form : Try Risk Free

People Also Ask about 11 preliminary change latest

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 11 preliminary change latest online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.